Maxim Remchukov

ESG is growing in importance for businesses and stakeholders everywhere.

The pandemic is helping increase awareness that companies must focus on long-term sustainability over short-term profits.

It will serve as a litmus test, dividing those firms who are serious about a low-carbon future – and those who are not.

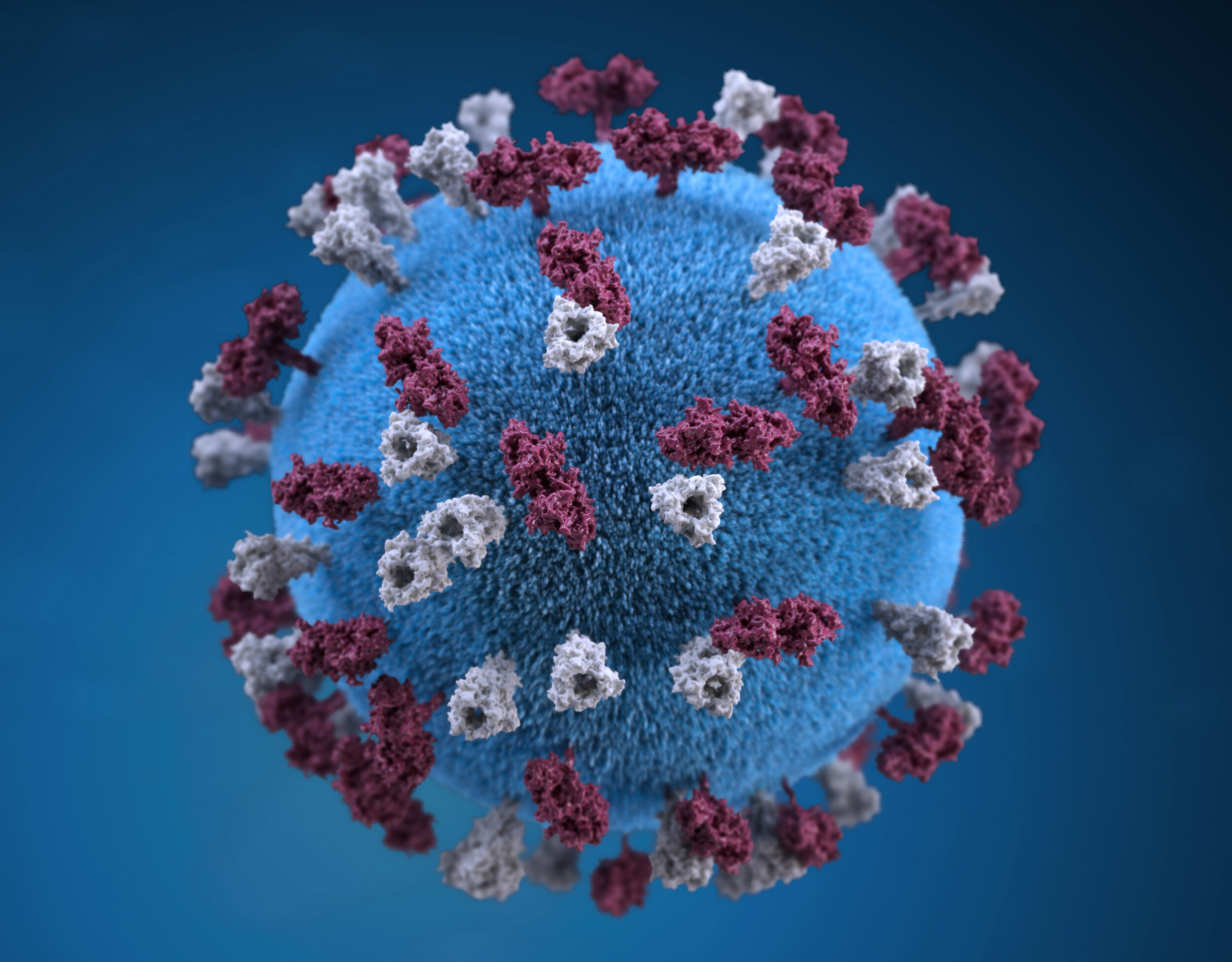

The pandemic has proven the viability of the environmental, social and governance (ESG) agenda for both stakeholders and investors. It has specifically elevated the significance of social factors in the current moment, and environmental factors in the long-term.

In the first four months of 2020, investors poured a record $12.2 billion into ESG funds. The steady inflow is explained by the profitability of ESG investments, which have turned out to be remarkably resilient to disruption. For instance, more than 70% of ESG funds for all asset classes outperformed their competitors. And at the end of the second quarter there were 534 index funds focused on sustainability, overseeing a combined $250 billion in Europe and the United States.

Businesses with agile management systems, a corporate commitment to ESG goals and structural resilience are set to emerge as major beneficiaries of this shifting paradigm. A recent study showed that ESG has become an even greater focus for 23% of respondents and that the perceived importance of social considerations has risen by 20% since the onset of the pandemic.

The COVID-19 crisis is likely to increase awareness that companies must consider societal needs and ethical standards, not just short-term profits. This is particularly important for companies seeking to retain the skillsets of their workers and politicians striving to avoid societal discontent. Another study found that following layoffs at a firm, the remaining employees saw a 41% decline in job satisfaction, a 36% decrease in organizational commitment and a 20% decline in job performance. Such numbers further point to long-term negative impacts on health and, as a result, skillsets.

More studies prove that stock market outperformance depends on companies focusing on ESG factors that have a material impact on their business, such as waste reduction. In effect, the pandemic has highlighted concerns about the safety of secondary raw materials, the accumulation of medical plastic waste and the need for their proper disposal.

During the past months we have rediscovered the role of polymers in our lives, including disposable ones. In medicine, plastic remains one of the most important materials, since it almost completely solves the problem of contamination. In addition, it comes with reasonable price, ductility and high chemical resistance.

Four years ago, Mckinsey predicted that the volume of global plastic waste would grow to 460 million tons per year by 2030, taking a serious environmental problem to a whole new level. More than 76% of all plastic ends up as waste, and nearly 50% of plastics are used just once. The pandemic hasn’t changed this calculus and the problem of recycling and returning plastic waste to the cycle remains and requires a comprehensive solution.

Currently we are witnessing a tendency to suspend the transition to reusable products due to the epidemiological danger. But it is important to remember that the pandemic is not the time to negate the importance of the waste management problem. In contrast, it highlights the most vulnerable links in the supply chain that all industry players must work on.

When polymer waste cannot reach the processors due to epidemiological restrictions and more waste goes to landfill and incineration, the need for a systematic approach becomes more obvious. For instance, more than 450 organizations have signed up to a vision for a global plastics system in which plastics never become waste as part of the New Plastics Economy Global Commitment.

It is evident that we need more complex recycling practices and policies against plastic pollution that take into account extensive networks of transnational ties. The growing importance of sustainable development could be a good way to start treating the issue more effectively, in order to enable long-term environmental and economic benefits.

It is also worth keeping in mind that the scale of the current disruption might be just a rehearsal of a more dramatic slump in the future. Currently there is no shortage of studies predicting an apocalyptic future unless the world collectively reconsiders its commitment to ESG. https://www.youtube.com/embed/1ILv-IgYvxE?enablejsapi=1&wmode=transparent

Sustainable development goals and their integration into corporate strategies should perform the core role across corporate governance systems. This should not only reflect a popular recognition of the sustainability agenda, but also a keen commitment to take responsibility, which does not always entail maintaining a balance of costs and effect. For instance, economic recovery and adherence to ESG principles could facilitate the emergence of new ‘green’ financial instruments and social bonds.

The current crisis is likely to serve as a litmus test for those countries and corporations that are truly serious about ‘low-carbon investments’, and adhere to previously accepted ESG goals, and those that are not.

For instance, climate neutrality by 2050 is at the heart of the European Union’s Green Deal and is in line with the commitment to global climate action under the Paris Agreement. The proposed €750 billion fund to help the bloc recover will have a green focus, with 25% of all funding allocated for climate action.

Financing Sustainable Development

The world’s economies are already absorbing the costs of climate change and a “business as usual” approach that is obsolete. Both scientific evidence and the dislocation of people are highlighting the urgent need to create a sustainable, inclusive and climate-resilient future.

This will require no less than a transformation of our current economic model into one that generates long-term value by balancing natural, social, human and financial conditions. Cooperation between different stakeholders will be vital to developing the innovative strategies, partnerships and markets that will drive this transformation and allow us to raise the trillions of dollars in investments that are needed.

To tackle these challenges, Financing Sustainable Development is one of the four focus areas at the World Economic Forum’s 2019 Sustainable Development Impact summit. A range of sessions will spotlight the innovative financial models, pioneering solutions and scalable best practices that can mobilize capital for the the world’s sustainable development goals. It will focus on the conditions that both public and private institutions should create to enable large-scale financing of sustainable development. It will also explore the role that governments, corporations, investors, philanthropists and consumers could play to deliver new ways of financing sustainable development.

There are many good examples across the corporate sector. Euinor, Shell and Total have decided to invest in the Northern Lights project in Norway’s first exploitation license for CO2 storage on the Norwegian Continental Shelf. Total has also committed to become a net-zero emission company for all its European businesses by 2050. These cases should be applauded universally and used to motivate other companies to follow suit.

The best way to continue is to acknowledge that there is a need of maintaining a balance between ESG factors and strict corporate commitment to their resilience.

The growing maturity of the ESG agenda contributes to the sustainability goals and businesses’ ability to withstand external challenges. Since the risks in sustainable development are financially expressed in one way or another, the ability to manage them does not lose its relevance during any external crises and is one of the factors of long-term “survival”.